Budget 2023: Buyer’s stamp duties for property purchases to be raised from Feb 15

The government has announced an increase in the top marginal rate of Buyer’s Stamp Duty (BSD) for both residential and non-residential properties in order to make the BSD regime more progressive.

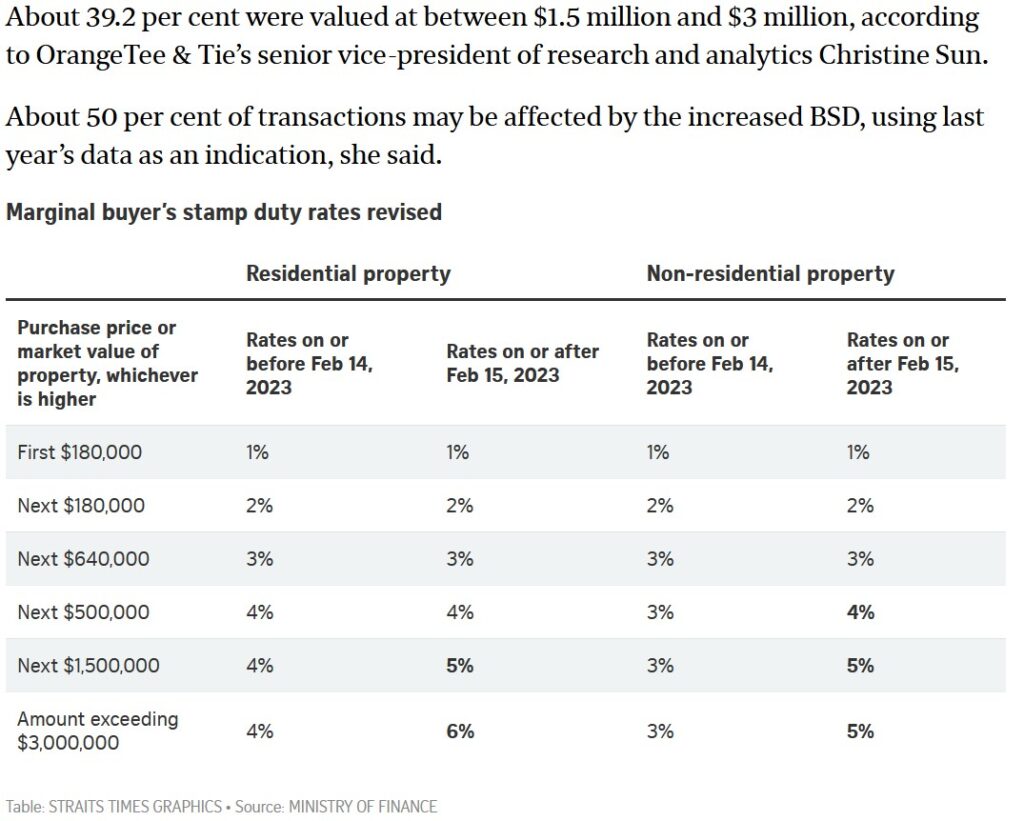

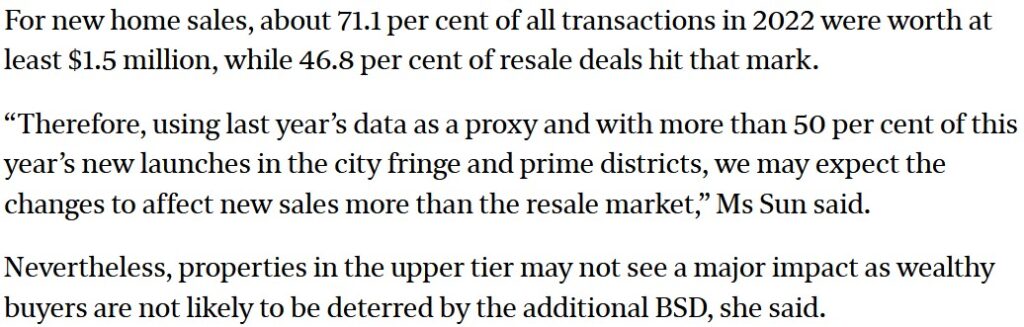

Starting from February 15th, 2023, the revised rates will apply to all properties purchased on or after that date. Specifically, for residential properties, the 5% tax rate will apply to the portion of the property’s value that exceeds $1.5 million and up to $3 million, while the 6% tax rate will apply to any value exceeding $3 million. The non-residential properties will also be subject to higher taxes, with a 4% tax rate applying to the portion of the property’s value that exceeds $1 million and up to $1.5 million, and a 5% tax rate applying to any value exceeding $1.5 million.

Source: The Straits Times

Book An Appointment to view The Continuum ShowFlat & get VVIP Discounts (Limited Time), Direct Developer Price, & Hardcopy E-Brochure. Guaranteed with Best Price Possible.

OR

Fill up the form on the right and get a copy of The Continuum Price, E-Brochure, and Latest Updates!

Strictly no spam policy.